This is a guest post from Ryan Higginson, Vice President & UK/ROI Country Leader, Pitney Bowes who today considers what’s next for the UK’s carriers:

As we enter what is set to be another record breaking year for shipping and logistics companies, Ryan Higginson, Vice President & UK/ROI Country Leader, Pitney Bowes, reflects on the early analysis of 2021’s peak season, and turns his eyes forward with predictions for the year ahead.

Parcel volume for 2021’s peak season look set to break previous records. Despite supply chain disruption and pessimistic forecasts from industry experts, on the whole carriers delivered – and delivered – even when curveballs were thrown at them. In mid-December, Royal Mail had to find the capacity to double the delivery of lateral flow and PCR tests to 900,000 each day, during what would have been the busiest week of the year even without this extra pressure. Hermes expected to beat their busiest day of the year in 2020 – December 1st – on which they handled 3.5 million parcels during the 24 hour period. FedEx suggested December 16th would be its busiest day in the history of its business across Europe, the Middle East and Africa.

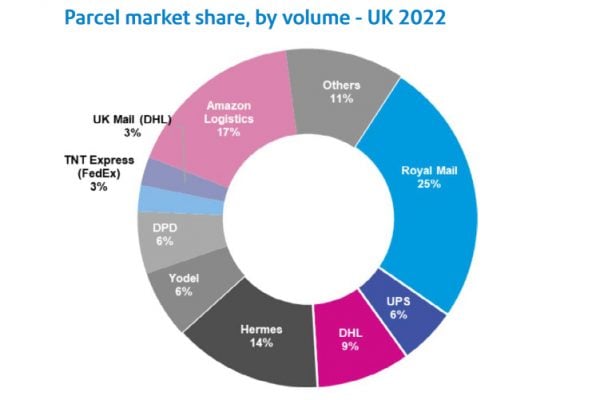

While carrier volumes for 2021 are still to be confirmed, they’re likely to remain consistent with 2020’s figures, which identified that Royal Mail ship the highest number of parcels in the UK in at 1.7 billion. This is followed by:

- Amazon Logistics with 750 million

- Hermes with 630 million

- DHL with 390 million

- DPD shipped 250 million

- Yodel 250 million

- TNT (FedEx) with 150 million

- UK Mail (DHL) 110 million

Hermes grew parcel volume the highest at 63 percent followed by:

- UK Mail and DHL at 40 percent

- DPD by 39 percent

- TNT/FedEx by 37 percent

- Amazon Logistics at 36 percent

- Royal Mail with 32 percent growth

- Yodel by 30 percent year-on-year

Under incredibly challenging circumstances, carriers’ extensive investments in people, infrastructure and digital capabilities has paid off. But what will they face this year? Will consumers continue to shop online – and will parcel numbers keep on rising?

The outlook for 2022

Carrier capacity will be stretched to the limit in 2022 as driver shortages and supply chain disruption continues. In the UK alone, around 160 parcels are generated every second. That’s 5 billion a year. Prior to the pandemic, volume grew year-on-year by an average of 8%. In 2020 the growth rate for parcel volume more than quadrupled from the previous year, from 7% growth in 2019 to 33% in 2020. Forecasts for 2021, 2022 and beyond highlight continued growth. Our modelling forecasts predict UK parcel volume to have reached between 5.4 billion and 6 billon parcels in the UK in 2021, at around 12% growth – but market uncertainties require flexibility in our forecasts. In 2022, we expect numbers to reach over 6 billion. In the UK, almost 70% of this volume is generated by ecommerce. BOXpoll™ from Pitney Bowes found that in December 2021, 38% of all purchases were made online. 41% of consumers continue to shop more online than they did before the pandemic.

Carriers will continue to extend their transformation programmes with collective goals of achieving economies of scale; improving the customer experience and driving greater value; delivering further digital capabilities; and finding new ways to ensure the safety of employees and customers. In the UK in 2020, revenue per parcel increased for the first time since 2016, reaching $4.40.

Expect to see:

- Automation: investment in connected technologies which minimise manual inputs, improve accuracy, productivity and speed is likely to continue. Automated parcel-sorting technologies such as those in Royal Mail’s Warrington site and Hermes’ small items sorters remain popular, to help carriers increase capacity and efficiency. At the same time, carriers will continue to invest in their fleet and in sustainability as they hold themselves accountable for targets.

- More mergers and acquisitions: the Logistics sector has been busy for some time in M&A. BDO’s UK Logistics Confidence Index found 42% of survey respondents saying they were likely to make acquisitions in the next year. This is the highest level since the study began nine years ago. In 2021 DPD acquired CitySprint and Hermes partnered with Tesco to widen its Parcel-shop network in order to increase out of home delivery options.

- Partnerships to extend service capabilities: carriers will continue to collaborate to accelerate deliveries and provide new services. Once a service used by business-to-business clients, same-day delivery is now a reality for consumers in many locations across the UK. Retailer Boots offered same-day delivery in December in partnership with Deliveroo. Selfridges teamed with DPD to offer same-day delivery within the M25.

- New market entrants: initially in the areas of grocery and fast-food deliveries, we’re likely to see some exciting new market entrants in 2022. Online grocery stores Beelivery has developed capabilities to offer same-day grocery delivery across 90% of the UK, from a local store, with 15-60 minutes the average delivery time. Gorillas say they’ll deliver groceries within 10 minutes, and firms including Jiffy, Weezy and Getir continue to disrupt the grocery delivery market across the UK’s major cities. We could see these firms begin to partner with non-grocery retailers – similar to Deliveroo and Boots – and compete with carriers.

- Further investment in people so that carriers can continue to deliver at scale: as the skills shortage continues, carriers will continue to compete for staff, investing in benefits, training and safety measures to protect and retain their employees. Hermes, for example, is investing in its Self Employed Courier programme, guaranteeing a minimum income and benefits, while DPD is investing in digital skills training.

- Efficiency in the last mile: carriers will continue to trial new ways to deliver efficiency to the last mile, with strategies to reduce costs, sustainably. FedEx Express recently launched 13 e-cargo bikes to Edinburgh, Glasgow and Cambridge, in addition to its fleet in London’s low-emission zones, while DPD anticipates it had 1700 electric vehicles on the UK roads at the end of last year and Royal Mail began the rollout of 3000 additional electric vans to its fleet late last year.

In times of crisis, it’s not uncommon to see creativity and innovation thrive. I’m certain we’ll see this in 2022, as our carriers continue to transform and deliver.